?After a small break I am back to show some of the interesting features of OpenERP 6.0. In this blog I am going to explain how you can configure and use the payroll efficiently which is also integrated to the holiday management and accountings. The major changes in payroll module are, you can use this module without installing the accounting module. The dependency to the account module is removed in the 6.0 which was there in the version 5.0. So, there are two different module hr_payroll and hr_payroll_account.

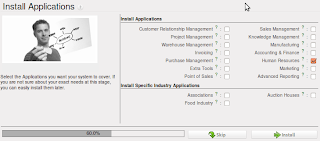

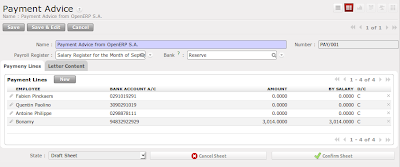

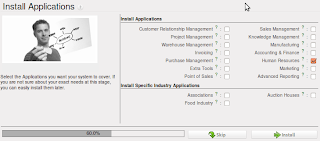

Lets install the payroll module, follow the steps described below.

|

| Select the Human Resource Application |

Customize the Human Resource application further to have the capabilities of the payroll.

|

| Select the Payroll Management |

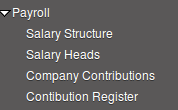

Lets start with the Configuration

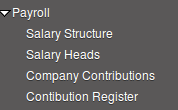

|

| Payroll Configuration |

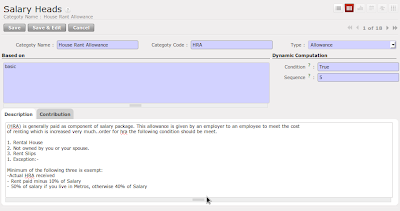

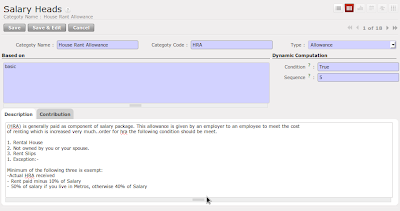

Payroll configuration is very easy, there are two important objects that we have to configure to run the payroll calculations and other computations. First and most important object is Salary Heads, which is used to define the major heads of salary.

|

| Salary Heads - HRA Configuration |

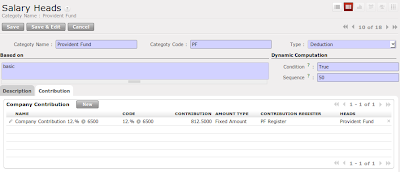

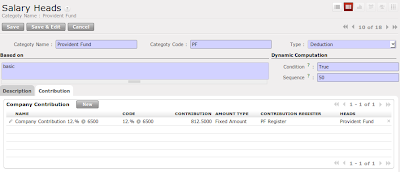

Look at the detailed configuration for the head Provident Fund, where we have to configure the company contributions on the head. You can define the list of contributions and associated register. Using contribution register you can track the contribution of the employee and company.

|

| Salary Heads with Contribution configuration |

The most important configuration in salary heads are the fields named 'code', 'based on' and 'sequence', all codes becomes variable so that you can use these all variables in calculating the base amount for any other salary heads, all used variables in calculations should required to have more priority. Lets take an example normally in India some allowances like house rent allowance (it is in % and not fix) is based on the basic + da so you can configure in this way, Based on house rent allowance could be basic + da, where basic is the predefined variable and da is the code of Dearness Allowance head.

List of predefined variables you can use : basic, gross, net

Some of the example to construct the base : (basic + da) / 5 * hra

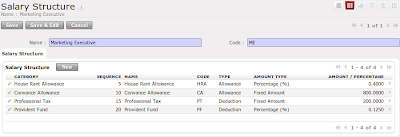

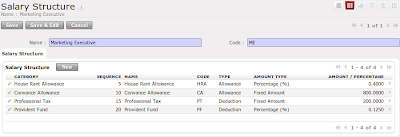

So, Here we finished the configuration of the salary heads. Lets see how to define the salary structure, normally salary structure is nothing but the breakup of the salary in terms of allowances and deductions so that some of the allowances and deductions employee can claim for saving the tax. Again salary structure definition is based on the company policy and employee's grades or pay scale.

|

| Salary Structure for Marketing Executive |

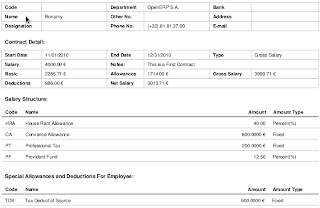

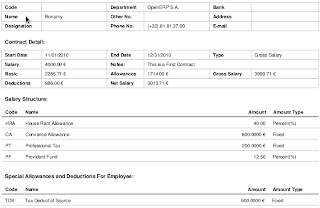

Now, you must be thinking that if this is the fix structure for the marketing executive then where to configure the incentive on sales or special allowances based on the contract ?, There is a way that you can add the special configuration in the employee where you can define the special allowance and deductions for the specific employees. Lets see how to configure the employee special request to deduct the 500 Rs of tax every month.

|

| Special Computation for Employees |

Look at the Salary structure report, its improved a lot, so now you can see the employee's basic salary, gross salary and Net salary, also you can see the list of allowance and deductions with the total amount.

|

| Employee's Salary structure includes detailed Information |

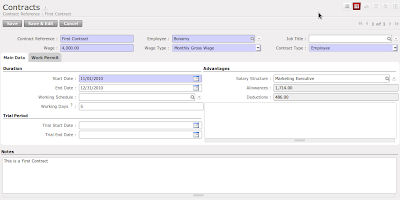

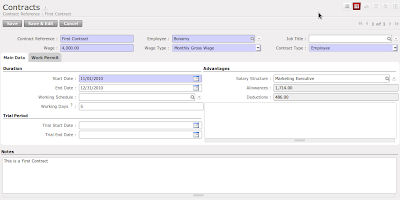

Now finally we have to link the salary structure to the employee contract, where we have to define the employee's wages details and breakup in terms of the salary structure.

|

| Basic pay 4000 with the Marketing Executive Pay Scale |

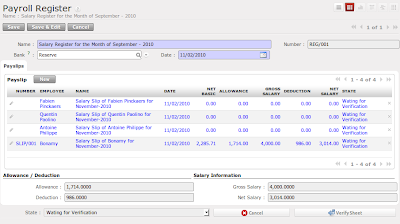

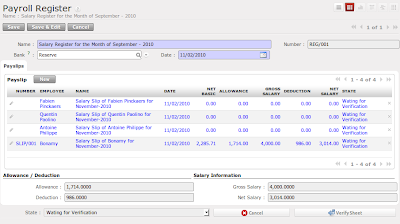

Lets go to the salary calculation process that HR manager has to do every month.

- Prepare a Salary Register

- Prepare the Bank Advice

Every month hr manager have to prepare a salary register form the Payroll Register menu. Just open form and configure few things like Name of the Register, and Bank details, and press the compute button. It will compute the salary slip for all employees.

|

| Salary Register of September - 2010 |

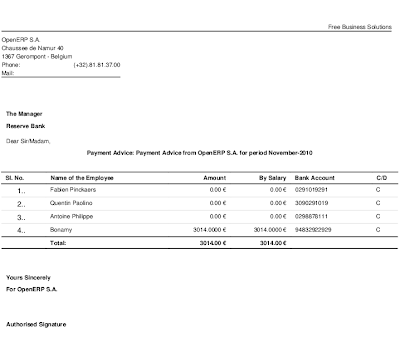

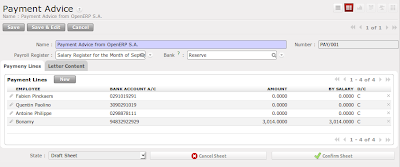

Once you go through all the verification procedures like HR Check, Account Check you will get the Payment advice created under the Payment Advice Menu. You just have to type the required message, cheque numbers in side that advice and you can directly give this for the salary payment along with the pay order / cheques.

|

| Bank Payment Advice |

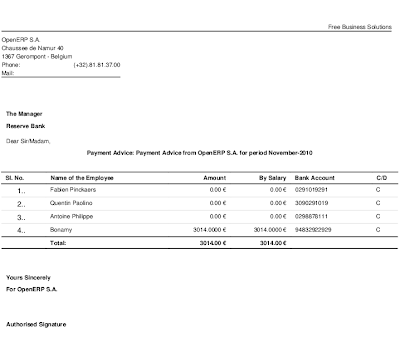

Payment Advice Report

|

| Payment Advice - Reports |

So, this is very small introduction about the OpenERP 6.0 Payroll module. The major change in the OpenERP 6.0 payroll module is it won't install the accounting if you just want to run the payroll without accounting. If you wanted to do the integrated accounting then install the module hr_payroll_account. May be in my next post I will try to make complete video for the payroll processing.

Dear Mantavya

RépondreSupprimerthank you for the post

please in this new payroll it is possible to clearly seperate in the payslip the taxes paid by employee for the taxes paid by employer based on a percentage

for example

for taxes t1 employee part is 2% of gross salary and employer part is 5% of the gross salary

is payroll 6 can manage this requirement

Best regards

Hello, can you change the images to bigger ones please. Thanks.

RépondreSupprimerIn the "Based on" field of the salary heads, can we put in conditional expressions? Also what syntax does this use? For example for my country, the IRS tax code is something like this

RépondreSupprimerif(basic <= 84) then

tax = 0

else if (84 < basic <= 104) then

tax = basic * 5%

else if (104 < basic <= 164) then

tax = 1+10%*(basic - 84)

else if (164 < basic <= 1350) then

tax = 7+ 17.5%*(basic - 164)

else

tax = 214.55+ 25%*(basic - 1350)

Thanks in advance for the help

Would you advise me how to install hr_payroll in OpenERP 6.0 or 6.02. I got an error, pls refer to: http://www.openerp.com/forum/post85239.html?hilit=payroll#p85239

RépondreSupprimerThe payroll businesses will offer you the ability to free up more time and resources completely. This will also eliminate the necessity for you to become an expert on topics such as withholding amounts.

RépondreSupprimerPayroll

Ce commentaire a été supprimé par l'auteur.

RépondreSupprimerI am looking online for the best payrolling service with number of secure, web-based services, including General Ledger Reporting.

RépondreSupprimerThe structure is well driven which makes it more impressive./

RépondreSupprimermerchant account services

Is there any way to get hourly wages to work?

RépondreSupprimerOpen ERP 6.o payroll module's content is so good as per information. We look forward at this kind of system to get. You full field my requirement. I am thankful to you for this article. Keep sharing your info.

RépondreSupprimerERP software

I truly like to reading your post on ERP 6.0 payroll module. Thank you so much for taking the time to share such a nice information.

RépondreSupprimerPayroll Services

thanks 4 ur infor' really really needful.!

RépondreSupprimerneed to know, How to create salary rule when worker works in holiday (1st of may,25 december) and we need to pay salary x 1.5?

we also need to pay bonus when he worked preceding 3months with more than 75% attendance.

Can we create such rules or do we need to write method in Python ?

ERP software, in turn, is designed to improve both external customer relationships and internal collaborations by automating tasks and activities that streamline work processes, shorten business process cycles, and increase user productivity.

RépondreSupprimerThanks...

ERP Software System

Its fantastic to read something on ERP module. ERP module is very important for each and every business.you post includes all nice information about erp module which helpful for me.Thanks for sharing.

RépondreSupprimerConstruction ERP Modules

Informative and useful blog. Being a Payroll Services Guelph, I always search for new and useful payroll related information.

RépondreSupprimer

RépondreSupprimerNice post and good information about Payroll Services. It is very useful information. Really this new Thanks for sharing.

Payroll Services In London

Accountancy Agencies In London

Ce commentaire a été supprimé par l'auteur.

RépondreSupprimerInterestingly, the concept of a supply chain management market distinguishable from and ERP market has never really taken hold.

RépondreSupprimerERP Market in India

he PF can be an important pillar in a retirement plan, but the corpus of the average subscriber is likely to fall woefully short of his requirement.

RépondreSupprimerProvident Fund Management System

i really like your post after reading such a great post. SG Accountants ilford

RépondreSupprimerAccountants near me

This post is unique for me.

RépondreSupprimerHR payroll software

VRay 6.00.05 Crack will introduce the basic theories instantly right into production. Adding the brand's newest interface, project usage.RekordBox Dj Crackeado

RépondreSupprimerWe can speak that Mixed In Key Crack is an inspiring software which will allow you to mix your sounds simply. Mixed In Key 10 Free Download can be second-hand in mixture. Mixed In Key Free Download

RépondreSupprimer